Tax Shield What Is It, Formula, How To Calculate, Examples

Similar to the tax shield offered in compensation for medical expenses, charitable giving can also lower a taxpayer’s obligations. In order to qualify, the taxpayer must use itemized deductions on their tax return. The deductible amount may be as high as 60% of the taxpayer’s adjusted gross income, depending on the specific circumstances. For donations to qualify, they must be given to an approved organization. We note that when depreciation expense is considered, EBT is negative, and therefore taxes paid by the company over the period of 4 years is Zero.

Tax Shield: Definition, Formula For Calculation, And Example

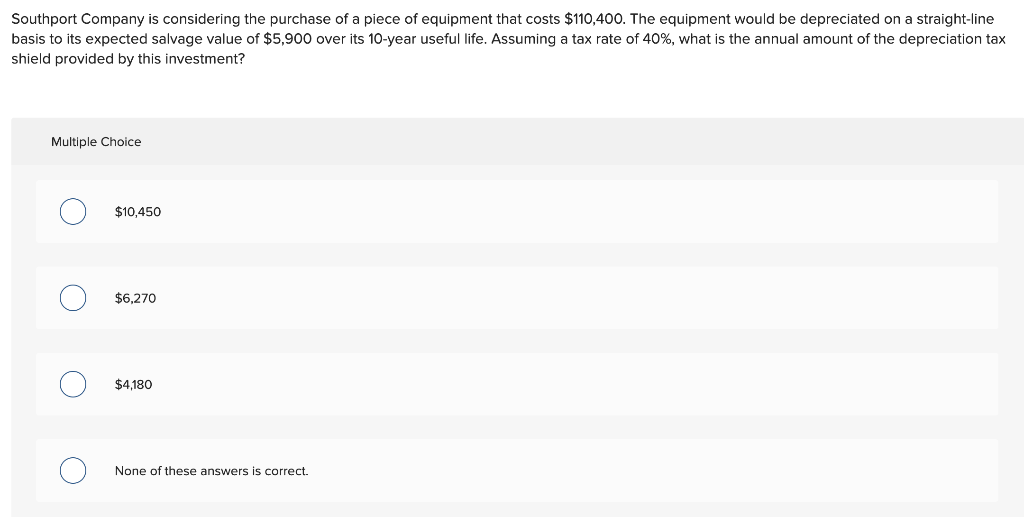

It is necessary to understand the importance of the concept of depreciation tax shield equation in the corporate environment as a temporary benefit to save taxes. However, when we calculate depreciation tax shield, even though the tax amount is reduced due to depreciation, the company may eventually sell the asset at a profit. This will again partly offset the income saved from previous tax reductions. Since depreciation expense is tax-deductible, companies generally prefer to maximize depreciation expenses as quickly as they can on their tax filings. Corporations can use a variety of different depreciation methods such as double declining balance and sum-of-years-digits to lower taxes in the early years. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed.

Tax Shield Formula Explanation Video

D&A is embedded within a company’s cost of goods sold (COGS) and operating expenses, so the recommended source to find the total value is the cash flow statement (CFS). The ability to use a home mortgage as a tax shield is a major benefit for many middle-class people whose homes are major components of their net worth. It also provides incentives to those interested in purchasing a home by providing a specific tax benefit to the borrower. We note from above that the Tax Shield has a direct impact on the profits as net income will come down if depreciation expense is increasing, resulting in less tax burden. The factor of (1-t) reduces the debt component which results in a lower WACC which in turn results in a higher present value of net cash flows. Where we is the weight of equity, ke is the cost of equity, wd is the weight of debt, kd is the pre-tax cost of debt (i.e. its yield to maturity) and t is the tax rate.

The Tax Impact of Depreciation

CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. Therefore, the 1st option is better since it offers a lower cost the 6 best accounting software for nonprofits of 2021 of acquisition. The Depreciation Tax Benefit reflects the money saved on Income Taxes due to Depreciation Expense. To wrap this up, we hope you now have a much better understanding of the Depreciation Tax Shield Calculation as well as the underlying concept.

- This will become a major source of cash inflow, which we saved by not giving tax on depreciation.

- The intuition here is that the company has an $800,000 reduction in taxable income since the interest expense is deductible.

- By minimizing taxable income, individuals and businesses can increase their after-tax cash flow, allowing for reinvestment, debt reduction, or simply saving for future goals.

- The lower the taxable income, the lower the amount of taxes owed to the government, hence, tax savings for the taxpayer.

- However, it is important to consider the effect of temporary differences between depreciation and capital cost allowance for tax purposes.

This a tax reduction technique under which depreciation expenses are subtracted from taxable income.is is a noncash item, but we get a deduction from our taxable income. This will become a major source of cash inflow, which we saved by not giving tax on depreciation. The concept of annual depreciation tax shield is identified as an important factor during financial decision-making by the management in case the business is highly capital-intensive. The business operation will involve the use of assets of larger value resulting in a substantial amount of depreciation being deducted from the taxable income. Therefore, it is important to understand the formula used to calculate depreciation tax shield, as given below.

Understanding a Tax Shield

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. The taxes saved due to the Interest Expense deductions are the Interest Tax Shield.

As for the taxes owed, we’ll multiply EBT by our 20% tax rate assumption, and net income is equal to EBT subtracted by the tax. Therefore, depreciation is perceived as having a positive impact on the free cash flows (FCFs) of a company, which should theoretically increase its valuation. Because depreciation expense is treated as a non-cash add-back, it is added back to net income on the cash flow statement (CFS). In the final step, the depreciation expense — typically an estimated amount based on historical spending (i.e. a percentage of Capex) and management guidance — is multiplied by the tax rate.

For example, if a company has an annual depreciation of $2,000 and the rate of tax is set at 10%, the tax savings for the period is $200. It should be noted that regardless of what depreciation method is used the total expense will be the same over the life of the asset. Thus, the benefit comes from the time value of money and pushing tax expenses out as far as possible.

The higher the savings from the tax shield, the higher the company's cash profit. The extent of tax shield varies from nation to nation, and their benefits also vary based on the overall tax rate. The term "Tax Shield" refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government. The formula for tax shields is very simple, and it is calculated by first adding the different tax-deductible expenses and then multiplying the result by the tax rate.

The tax shield on interest is positive when earnings before interest and taxes, i.e., EBIT, exceed the interest payment. The value of the interest tax shield is the present value, i.e., PV of all future interest tax shields. Also, the value of a levered firm or organization exceeds the value of an equal unlevered firm or organization by the value of the interest tax shield. For example, because interest payments on certain debts are a tax-deductible expense, taking on qualifying debts can act as tax shields. Tax-efficient investment strategies are cornerstones of investing for high net-worth individuals and corporations, whose annual tax bills can be very high. The term "tax shield" references a particular deduction's ability to shield portions of the taxpayer’s income from taxation.

A tax shield on depreciation is the proper management of assets for saving the tax. A depreciation tax shield is a tax reduction technique under which depreciation expenses are subtracted from taxable income. The expression (CI – CO – D) in the first equation represents the taxable income which when multiplied with (1 – t) yields after-tax income. Depreciation is added back because it is a non-cash expense and we need to work with after-tax cash flows (instead of income).